[ad_1]

For house owners, massive assignments and purchases might be one more casualty of rampant inflation, new exploration indicates.

All round, 60% of house owners in a the latest survey are less comfortable producing huge purchases for their dwelling or domestic mainly because of rising rates, according to Hippo Insurance’s 2022 Home owner Preparedness Report. And nearly 43% either strongly (14.4%) or rather (28.4%) concur that inflation has caused them to hold off planned house improvement or maintenance assignments.

The poll employed to make the review was carried out April 29 to May perhaps 1 among 1,915 U.S. adults, by Ipsos on behalf of Hippo.

Additional from Private Finance:

Charge to finance a new car or truck hits a record $656 for every thirty day period

How to get began setting up credit history as a younger adult

Here is what the Fed’s desire rate hike indicates for you

With inflation up 8.6% year around calendar year in May possibly — much more than predicted and the speediest speed since 1981 — households are struggling with rate raises in anything from groceries and gas to lease and clothes, according to the most recent details from the U.S. Bureau of Labor Figures. Commonly talking, demand from customers proceeds to outstrip source, which is hampered in many situations by supply-chain troubles.

Household housing design costs are up 19% from a yr back, according to the Nationwide Association of Household Builders. This can translate into larger expenses for home advancement projects, relying on the specifics. The housing market place seems to be cooling amid increased curiosity premiums and skyrocketing house rates, nevertheless the median listing selling price of a residence in the U.S. is $447,000, up 17.6% from a calendar year back, in accordance to Real estate agent.com.

‘Not all dwelling repairs are designed equal’

However, delaying some projects can be dangerous. Putting off routine upkeep can direct to greater repair outlays down the street. Previous year, house owners invested an regular of about $4,000 on dwelling repairs, the Hippo survey showed.

While it is clever to have dollars established aside for routine maintenance and repairs, you can also consider steps that might aid prevent high-priced fixes. For instance, be guaranteed to know exactly where the primary shutoff is for h2o. If you discover a leaking line from your refrigerator or washing device, turning off that valve can protect against worse water injury.

“Get started with a regime inspection of your household,” stated Courtney Klosterman, consumer trends qualified at Hippo. “Just take take note of any noticeable imperfections, this sort of as cracks in the basis or damp regions, which could be an early signal of mould.”

From there, Klosterman claimed, make a record of must-dos and pleasant-to-dos, so you can function via your list more than time.

“Prioritize challenges that are regarded to be costlier to restore these as drinking water leaks and any structural challenges all around the residence,” she mentioned. “Not all residence repairs are made equivalent, so it’s vital to search for symptoms that a project desires to be addressed swiftly.”

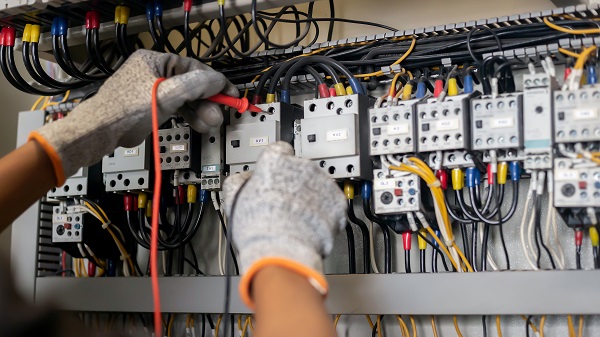

For illustration, malfunctioning important units, this sort of as a broken-down drinking water heater or an electrical brief ought to be prioritized, Klosterman reported. That’s also when certified experts should really be termed on to deal with the dilemma.

If you happen to be unsure wherever to commence when it comes to critical house servicing, you can obtain checklists on line, which include at web sites this sort of as Hippo or Homeadvisor.com.

Correction: This story has been updated to replicate the exact percentages of survey respondents who possibly strongly or relatively agree that inflation has brought on them to delay prepared house advancements.

[ad_2]

Supply website link

More Stories

Binghamton Home Improvement Grants You Shouldn’t Miss

How to Qualify for Binghamton Housing Repair Grants in 2025

Why Minimalist Interior Design Is the Ultimate Power Move