Constructing a new home or property is an exciting yet complex process. Unlike purchasing an existing home, building from scratch requires careful planning, coordination, and most importantly, financing. Traditional mortgages are not designed to cover the incremental costs of construction, which is where construction loans come into play. These loans provide short-term financing that supports every phase of the construction process, helping homeowners and investors turn their vision into reality.

What Are Construction Loans?

Construction loans are short-term loans that cover the costs associated with building a property from the ground up. Unlike conventional mortgages, which are based on the value of an existing home, construction loans are based on the projected value of the property once construction is complete. Lenders carefully review project plans, budgets, and timelines to determine the appropriate loan amount. Construction loans are particularly useful for those who want complete control over the design, layout, and finishes of their property.

How Construction Loans Work

Construction loans differ from traditional loans in structure and repayment. Typically, they are issued for 12 to 18 months, and funds are released in stages called “draws,” based on construction milestones. Borrowers usually pay interest only on the disbursed amount during construction, which reduces financial strain. After construction is finished, the loan can either be converted into a permanent mortgage or paid off with a separate long-term loan. This flexible approach ensures borrowers have access to funds as needed throughout the building process.

Types of Construction Loans

Several types of construction loans are available to meet different project needs:

- Construction-to-Permanent Loans: Combines construction financing and a permanent mortgage in one loan, simplifying the transition.

- Stand-Alone Construction Loans: Short-term loans used only for construction, requiring a separate mortgage afterward.

- Renovation Loans: Designed for major remodels or property additions, providing funds to improve existing structures.

- Owner-Builder Loans: For individuals acting as their own general contractor; requires experience and thorough documentation.

Benefits of Construction Loans

Construction loans offer many advantages to homeowners and investors:

- Customization: Allows full control over the design, layout, and finishes of the property.

- Interest-Only Payments During Construction: Reduces financial pressure while the property is being built.

- Draw-Based Funding: Funds are released as construction milestones are completed, preventing unnecessary upfront borrowing.

- Potential for Appreciation: Newly constructed properties often have higher market value than existing homes.

Who Should Consider Construction Loans

Construction loans are ideal for:

- Homeowners planning to build a custom dream home

- Real estate investors developing residential or commercial properties

- Borrowers with well-prepared construction plans and budgets

- Individuals seeking flexible short-term financing during construction

Challenges and Considerations

While construction loans offer flexibility, they also come with challenges:

- Higher Interest Rates: Typically higher than traditional mortgages due to the added risk.

- Complex Approval Process: Lenders require detailed construction plans, budgets, and contractor agreements.

- Short-Term Nature: Borrowers need a clear plan for repayment or conversion to a permanent mortgage.

- Budget Management: Careful monitoring is necessary to avoid cost overruns during construction.

Tips for Successfully Securing a Construction Loan

- Prepare detailed plans, including blueprints, materials, and construction timelines.

- Obtain multiple contractor bids to ensure accurate cost estimates.

- Maintain good credit and financial stability to improve approval chances.

- Work with lenders experienced in construction financing for smoother processing.

- Keep contingency funds available to cover unexpected expenses during construction.

Conclusion

Construction loans provide the necessary financing for building homes and properties from the ground up. With stage-based funding, interest-only payments during construction, and flexibility in repayment, these loans allow borrowers to manage their projects efficiently and effectively. Understanding the different types of construction loans, maintaining careful financial records, and collaborating with experienced lenders can help ensure a successful building project. For homeowners and investors looking to bring their vision to life, construction loans are an essential tool to turn plans into reality.

More Stories

Why Travelers Love Tune Hotel KLIA2 for Easy Airport Stays

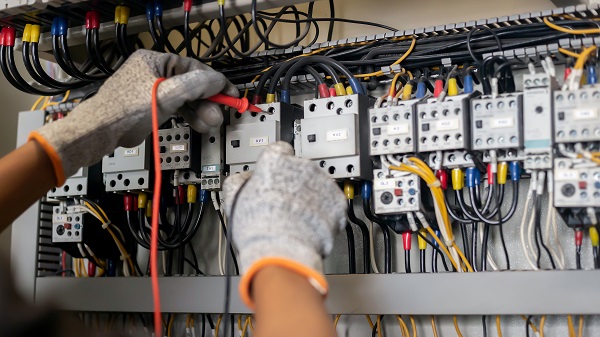

Professional Electrician-Pflugerville Services You Can Depend On

Budget-Friendly PVC Fence Ideas to Upgrade Your Yard