[ad_1]

Sergei Dubrovskii

Houston-centered Helix Energy Alternatives Team, Inc. (NYSE:HLX), or “Helix,” is just one of the world’s primary offshore strength specialty products and services businesses.

The business operates via a few segments: Effectively Intervention, Robotics, and Generation Amenities, with the properly intervention business now contributing about two thirds of revenues.

Helix recently obtained the Alliance team of companies (“Alliance”) for $120 million in dollars, a Louisiana-based mostly company of expert services in assist of the upstream and midstream industries in the Gulf of Mexico shelf, including offshore oil subject decommissioning and reclamation, undertaking administration, engineered solutions, intervention, maintenance, fix, heavy raise and business diving providers.

The acquisition will lead Modified EBITDA of up to $25 million and enhance consolidated income by about 15% this yr.

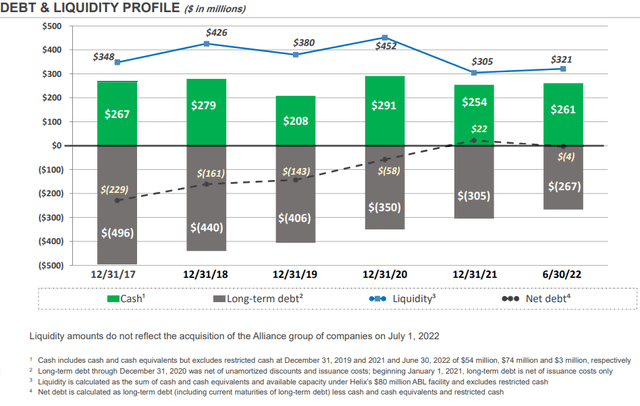

Helix has performed fairly well for most of the marketplace downturn as monetary effects had been boosted by a variety of large-margin legacy contracts. As a consequence, the company has not only managed to remain afloat but also minimized debt substantially in modern decades:

Firm Presentation

Remember to observe that the recently finished Alliance acquisition will lower hard cash on hand by $120 million subsequent quarter.

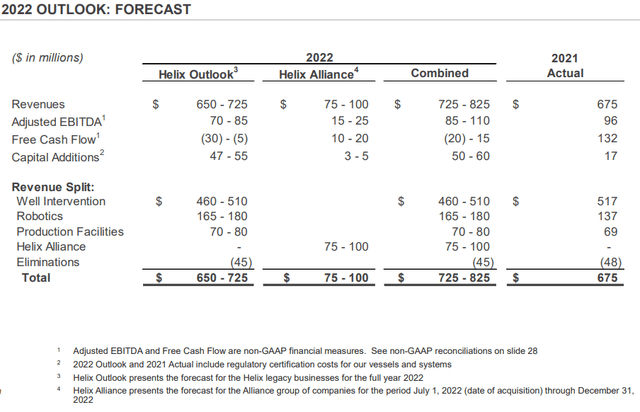

That mentioned, administration expects 2022 to be a transition year with several vessels undergoing regulatory inspections, a sluggish return for the North Sea current market and a amount of units undertaking brief-phrase operate at diminished prices with the company’s two modern day well intervention vessels in Brazil triggering an approximated $35 million EBITDA hit by itself.

As a final result, the mixed company’s cost-free income circulation will only be close to break-even amounts, down from $132 million recorded final calendar year:

Enterprise Presentation

But matters are expected to alter for the better likely into the second half and up coming calendar year as company ailments are bettering throughout all segments as said by management on the Q2 meeting contact:

More robust utilization, escalating premiums and in certain areas of the small business, prices are increasing much better and faster than we expected together with superior conditions and circumstances. We are securing for a longer period time period contracts and on the lookout to see more operate with some of the Well Intervention assets into 2025.

(…)

Not only have the uncertainties of 2022 starting to be apparent, we also have possibly the finest visibility in new many years at this stage for what might occur next year in 2023.

(…)

We’ve referred to as 2022 a transition yr for Helix. We absolutely intend to transition from a weak market in ’22 to a superior need industry in ’23 and outside of.

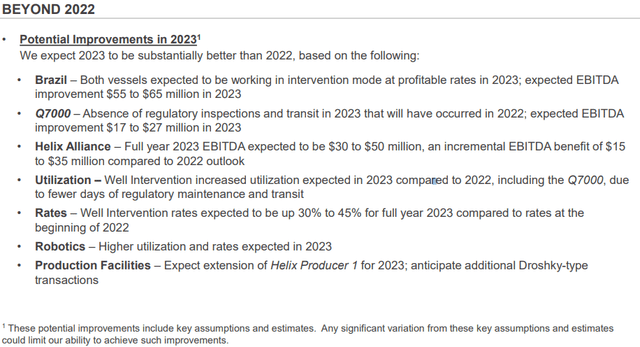

In the Q2 presentation, Helix projected up to $127 million in EBITDA advancements in 2023 based on expectations for well intervention premiums staying up concerning 30% and 45% for the comprehensive year as opposed to costs at the commencing of 2022.

The enterprise also forecasted better utilization and costs for the Robotics segment up coming 12 months.

Corporation Presentation

Individually, I am anticipating Modified EBITDA of at least $225 million in 2023, more than double the superior stop of the company’s projection for this year.

At this degree, Helix should really return to considerable free of charge dollars movement era next calendar year.

With the corporation buying and selling at just 2.7x EV / Adjusted 2023 EBITDA in spite of current anticipations for a multi-calendar year recovery in the offshore oil and fuel marketplaces, Helix appears to be like remarkably low-cost.

Bottom Line

Whilst 2022 will be practically nothing to publish property about for Helix Power Methods, the firm initiatives considerable improvement likely into following 12 months with the likely to at least double Modified EBITDA from anticipated 2022 amounts.

Even immediately after the new acquisition of Alliance, Helix continues to have a strong equilibrium sheet with reduced net debt levels and decent liquidity which must enhance substantially around the following couple of quarters.

With the company trading at just 2.7x projected EV / Altered 2023 EBITDA, Helix appears really low-cost.

That mentioned, with shares up by just about 40% from modern lows, traders ought to take into account waiting for a setback right before opening a situation.

Get extensive Helix Power Solutions to attain exposure to the expected multi-calendar year restoration in offshore oil and gasoline services. Assuming no major provide-off in oil rates, I would hope shares to double from existing levels likely into upcoming year.

[ad_2]

Resource website link

More Stories

Binghamton Home Improvement Grants You Shouldn’t Miss

How to Qualify for Binghamton Housing Repair Grants in 2025

Why Minimalist Interior Design Is the Ultimate Power Move