Are Home Improvement Stocks Now Undervalued?

[ad_1]

The lockdowns of 2020 could have prompted individuals to put extra money toward their environment, boosting revenue for household advancement retailers Lowe’s (NYSE:Minimal) and House Depot (NYSE:Hd), but the financial and housing availability crunches of 2022 are keeping them there.

Furniture, electronics and house office set-ups aimed at building residence a far better position to stay and get the job done fueled 2020 purchasing, but with buyers struggling with climbing charges of fuel and food stuff, theyre going to residence enhancement outlets to deal with repairs by themselves and start off gardens. This is preserving expansion at Lowe’s and Property Depot sturdy, making them the two potentially worthwhile portfolio additions this summer season, in my belief.

Equally choices have increasing dividend yields, generating them attractive for value traders seeking to make passive money as nicely. Before you insert both of these property enhancement stocks to your portfolio, however, there are some cons to consider.

Lowes

Lowes (NYSE:Very low) is a home improvement retail chain functioning in the U.S., Canada and Mexico. It gives goods for construction, maintenance, repairs and reworking. The housing sector may possibly be cooling a minimal from the highs of 2021, which may perhaps inspire assignments in the household youre in.

Revenues for the firm have doubled about the previous ten years, and earnings per share are anticipated to develop all around 13%. Lowe’s has a dividend produce of 1.66%, and the business has a extensive monitor document of soaring dividends. That could help sweeten the deal for buyers.

Analysts price Lowe’s a get, even while bulls feel the company faces pitfalls from rising curiosity charges, supply chain challenges and flattening housing charges. Its well worth noting that the median age of houses in the U.S. is 39 years, an age when residences will want an rising amount of routine maintenance and could be candidates for remodeling.

Lowe’s will get a GF Rating of 96, driven largely by best rankings for profiability and expansion.

Residence Depot

Surpassing forecasts in nine of the very last 10 quarters, yet another significant U.S. home enhancement retailer, Dwelling Depot (NYSE:Hd), just lately claimed 10.7% growth in web gross sales yr-over-yr.

House Depot counts qualified contractors among its greatest prospects, and their major-ticket purchases ended up up 18% in the course of the past yr. EPS has developed 17% in excess of the earlier 3 several years and revenue is up 8% over the previous year, finding it a obtain ranking from analysts.

Home Depot has a dividend generate of 2.26%, generating it the extra attractive of these two stocks for individuals in research of dividends.

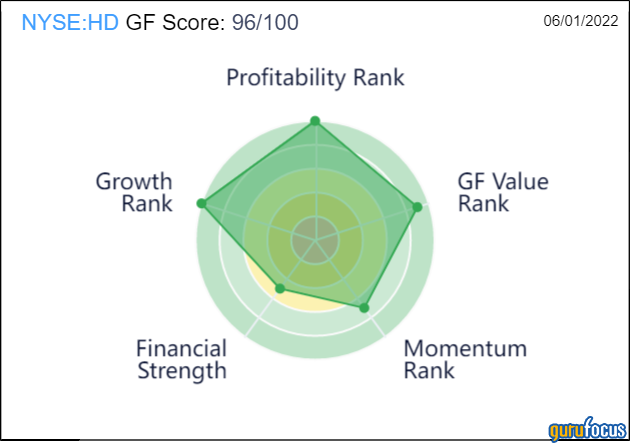

Like Lowe’s, Residence Depot also has a GF Rating of of 96/100. In addition to high growth and profitability, it scores greater than Lowe’s for GF Value, nevertheless it loses points for weaker momentum.

This article 1st appeared on GuruFocus.

[ad_2]

Supply hyperlink